How to increase the resale value of a new commercial property

Most business owners and developers planning to build a new commercial building want to maximise the potential resale value of their property even if they are not thinking of selling the property in the foreseeable future - it makes good sense, right?

So what drives the resale value of my property? And, what do I need to consider during the planning of my new building project to ensure the most successful outcome when I look to sell in the future?

In simple terms, the market demand and available supply determine the property value that is realised at the time of sale. The wider the range of potential tenants or end-users that the building appeals to, the more competition you will likely get when you sell it. On the flip side, a somewhat specialised building can demand a higher value as there isn’t anything else like it available on the market, i.e. a building with a gantry crane.

It is a high competition that wins gold. The more competition, the more likely you will get a better resale value.

What building features can increase the appeal and drive demand in the future?

/12984%20-%20G.jpg?width=800&name=12984%20-%20G.jpg)

The features below are not in order of importance. However, commercial real estate agents have found these building and property features to be critical for potential buyers and, in turn, have affected the final sale price of properties.

Slab thickness

Generally speaking, a 150mm thick floor slab would suit most applications for a warehouse storage building or an industrial workshop supporting items such as trucks, machines, and racking.

Overall stud height

A taller stud height typically caters for more uses and, when used as a storage facility, will increase the potential storage capacity. You can read more about selecting the best height for your commercial building here.

Span

It’s wise to consider the building span. As an example, you may need a building that is 2000m² to give you enough warehouse space for your growth goals. The way you can achieve this floor size is 25m x 80m OR 30m x 67m. The 30m design could be the better option as it will allow for a full-length truck inside the building, making the building attractive to a freight company or contracting firm in the future, while the 25m size would simply be too narrow.

Clearspan portal frames

Internal props or columns may seem like a way to save some money upfront but could limit the future uses of the building. Clearspan portals save the need for internal columns, increase the flexibility and efficiencies of the internal space, and in turn, can increase the potential resale value of your property in the future.

Door size

Large roller shutter doors future-proof the building and make it more useful for a wider range of applications. Allowing for trucks to access the building increases its potential future uses and will appeal to more end-users at the time of sale. Commonly, doors are 5m x 5m on an industrial building. However, having doors 6-7m wide gives more access options and reduces the chance of vehicles damaging the access points.

The ratio of office to warehouse

It’s okay to have a small office area compared to your warehouse space. However, if there is a large amount of office space compared to warehouse space, it can reduce the number of potential buyers or tenants down the track.

Good lighting

Good lighting such as clear-light roof panels in the warehouse or well-lit work areas, along with natural light in the office areas makes a huge difference to working conditions.

Carparking

Allowance for visitor car parking on site (preferably staff too) is something property buyers often consider. Lack of car parking can be a deterrent and can make the premises less user-friendly even though the recent parking legislation has removed minimum car park numbers (aside from accessibility parking).

Yard space

Some need yard space for outdoor storage and some need truck movement areas, while others need both. For property landlords/investors the yard space reduces the overall income rate for the property but without it, the property will have a much smaller spectrum of appeal. For example, a building with a relatively small coverage in comparison to the land is likely to return less for a property investor than a property of the same size with larger building coverage.

Drive-through capability for trucks

Multiple access points for the property can reduce the need for a turning area in the yard. Corner sites or properties that extend from one street to another can work well for this. A drive-through bay in the building may also be worth considering.

3 phase power

Many industrial machines require a three-phase power supply. Even if you don't require this, it may be worth considering still connecting to a three-phase power source to increase the potential resale value of your property.

Street appeal

Who likes an ugly building? Whether it’s an owner-occupier or a property investor, everyone prefers a building that has nice street appeal. There is however a balance between aesthetics and functionality. This is why consideration needs to be given to other properties in the area to ensure your building is fitting in aesthetically with the general area, while also optimising its functionality. This will ensure you get the best return on your property.

Ways to determine the value of a commercial investment property

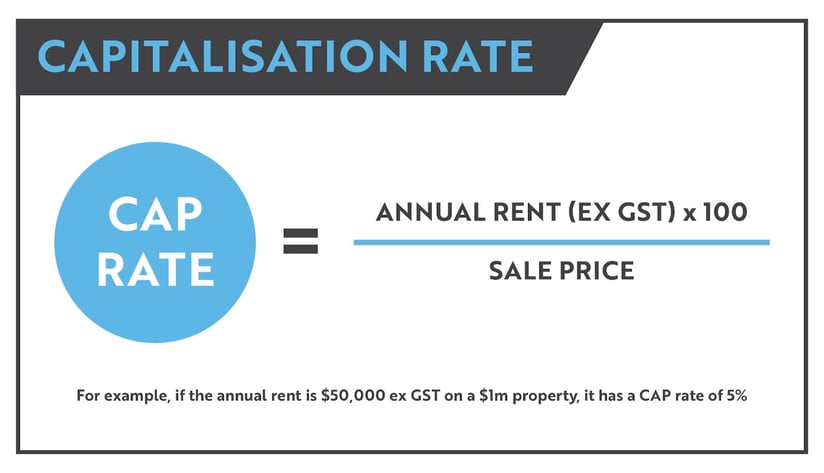

Capitalisation rate (CAP rate):

The higher the current or potential rental income the more your property is likely to be worth. When an investor is looking to purchase a commercial property they will often apply a capitalisation rate or CAP rate to the rental. For example, if the annual net rental income is $100,000 ex GST on a $2m property it has a CAP rate of 5%.

Weighted Average Lease Term (WALT):

Another factor is the WALT. WALT is critical because investors purchase a stable cash flow, so the perceived value of the property is determined by the level of income security.

The longer the average lease term, the more attractive it is to an investor. A lower WALT will reduce the number of buyers willing to take the risk on the shorter term tenant(s). Therefore, if it is very low, the price may be reduced.

On the flip side, if there is only a short-term remaining with no renewals, and if the building is attractive to multiple types of occupiers, you’re likely to get owner-occupiers wanting to buy so they can occupy as soon as the tenant has gone. So having a short WALT may not necessarily be a problem if the building is attractive to multiple users.

Vacant possession: If the building is attractive to a wide range of different businesses, you are likely to get both owner-occupiers and investors wanting to buy. If the building is in a strategic location and the owner-occupier market is strong, this can lead to very high resale values.

Location

Location is key for resale value. Property near transport and infrastructure, with parking facilities and appropriate businesses nearby, is highly valuable. We explain the various factors to consider before selecting land for your next commercial property in this guide. Quality locations, such as in a major city CBD or a sought-after industrial area, will offer lower yields but a decreased risk of vacancy or rent default. This may result in a lower capitalisation rate, however, it will also command higher resale prices and is more widely considered a better long-term option if you can afford them.

In conclusion, there are a number of elements to consider to ensure the best resale value for your commercial property while still ensuring the building's practicality for your current needs. If you are in the early stages of considering building a commercial or industrial building, feel free to get in touch with our friendly team of experts who are more than happy to offer some advice. Otherwise, the following resources may also be helpful: