Residential vs. Commercial Investment Property - Which is better?

Investing in real estate has long been a popular avenue for wealth creation and building financial security.

In New Zealand, both residential and commercial properties offer enticing investment opportunities. To make an informed decision, potential investors must carefully weigh the pros and cons of each option.

In this article, we explore the advantages and disadvantages of investing in residential and commercial properties in New Zealand, as well as those of buying and building a commercial property.

Residential Property Investment

Pros of Investing in Residential Property

Stable Demand: Residential properties cater to the fundamental human need for shelter, ensuring consistent demand. Population growth and immigration can contribute to sustained rental and capital value growth. While immigration slowed over COVID-19, the current net migration gains are expected to continue putting pressure on housing demand.

Larger Pool of Potential Tenants: The rental market for residential properties tends to be larger than commercial due to the broader demographic that requires housing. This can reduce the risk of prolonged vacancies.

Easier Entry: Investing in residential real estate typically requires a lower capital outlay compared to commercial properties, making it more accessible to individual investors.

Cons of Investing in Residential Property

Tenant Turnover: Residential properties may experience higher tenant turnover. This results in a higher frequency of property management tasks, such as screening new tenants and handling maintenance requests.

Regulations and Tenancy Laws: Residential property investors are subject to stringent tenancy laws and regulations that aim to protect tenants' rights. In some cases, this could lead to landlords bearing the cost of damage by tenants or lengthy disputes.

Property Management: Residential properties may involve more hands-on property management to ensure the rental meets relevant standards. As the house is someone's personal home, personal issues can spill over and affect the property management. Many people opt to use a property management company rather than have to deal with it themselves, which adds extra cost.

Market Saturation: Certain residential markets can become oversaturated, causing increased competition among investors. This also has the potential to limit rental yield and capital appreciation.

Interest Deductibility: For properties built before March 2020, interest has become a non-deductible expense for tax purposes. The new interest limitation rules have made the residential property market less attractive to many investors. As every scenario differs, we advise talking to a professional accountant or lawyer.

Bright Line Tax: Residential investment properties are typically subject to the Bright Line Test Regime. This results in capital gains being taxed if the property is sold within 10 years of purchase. In comparison, Capital Gains on commercial properties are generally non-taxable.

Commercial Property Investment

Pros of Investing in Commercial Property

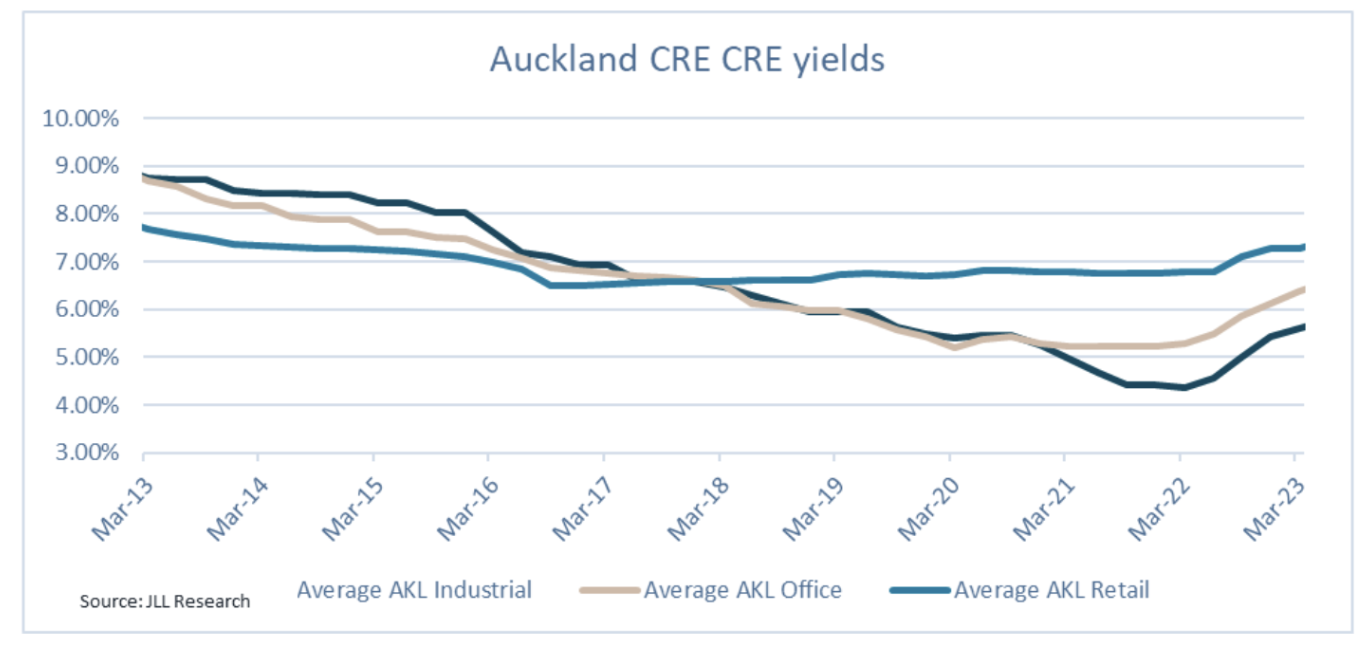

Higher Rental Yields: According to Gavin Read, the NZ Head of Research at JLL, commercial real estate (CRE) has historically offered higher rental yields than residential real estate (RRE). This makes commercial properties attractive to investors seeking regular income streams.

Source: JLL

Longer Leases: Commercial leases tend to have longer terms compared to residential leases. This provides a more predictable rental income with fewer vacancy periods.

Professional Tenants: Commercial properties tend to attract professional tenants, such as businesses and corporations. This typically leads to lower maintenance costs, better property care, and a less emotional tenant-landlord relationship. Compared to a home, this can make overall property management much easier.

Diversification: Investing in commercial properties can offer more diversification and less risk. This is because their performance is less correlated with the residential market.

Cons of Investing in Commercial Property

Higher Entry Barriers: Commercial property investments typically require higher upfront capital. They may also involve complex financial structures, making them less accessible to individual investors. This may mean you are much more dependent on one asset, rather than multiple residential properties.

Market Sensitivity: Commercial property values and demand can be more sensitive to economic fluctuations and business cycles. In economic downturns, this could increase risks.

Property Management Complexity: Commercial properties may require specialised property management expertise due to the unique needs and demands of commercial tenants.

Vacancy Risks: Finding new tenants for commercial properties can take longer compared to residential properties, leading to potential periods of vacancy.

Leverage: Typically banks will not lend as much for commercial as they will for residential. Gavin Read tells us “For an investment, the bank will generally fund less of the purchase prices of CRE, generally to a maximum 50% (although there are always exceptions), and then additional conditions on the funding from Loan to Value ratios, Interest Cover ratios and any other conditions they deem appropriate for the transaction. The level of funding for residential investment is also regulated by RBNZ with the Banks. For the purchase of a home (owner-occupiers), the RBNZ allows Banks to fund a percentage of low-equity home purchases (less than 20% equity). Also, the RBNZ will be introducing in the future the Debt-to-Income ratio for home lending. CRE and residential are different asset classes, and as such the RBNZ requires the banks to hold different capital ratios against their funding to their clients and this also impacts how funding arrangements will be structured and priced based on the quality of the transactions and the borrower."

Investing in any form of real estate presents distinct benefits and challenges. While residential properties offer stable demand and easier entry, they come with higher rates of tenant turnover and regulatory hurdles. On the other hand, commercial properties offer higher rental yields and longer leases but require more substantial upfront investment and are sensitive to economic conditions. As with any investment decision, thorough research, careful planning, and consulting with legal and tax experts are critical. You also need a clear understanding of individual financial goals are essential when choosing between residential and commercial property investment in New Zealand.

If you want to invest in commercial property, is it best to build or buy? Both options have their own advantages and disadvantages. The choice that's right for you will depend on your specific goals, resources, and risk tolerance so let's explore the pros and cons of each option.

Building a Commercial Property

Pros of Building a Commercial Property

Customisation: Building from scratch allows you to design the space according to your preferences. Before building on the land you own, you could market the building to a wide range of tenants and tweak the design to suit their needs. For prospective tenants, having some input into building specifications may mean they are more inclined to become long-term occupants.

Modern Infrastructure: A newly-built commercial property will usually have up-to-date infrastructure, technology, and energy-efficient features. This potentially reduces maintenance costs, attracts high-quality tenants, and allows you to charger higher lease rates.

Long-Term Vision: Building a property enables you to align it with your long-term investment and business goals, potentially enhancing its value and attractiveness to tenants.

Cons of Building a Commercial Property

Time-Consuming: The construction process can be lengthy and prone to delays due to weather, regulatory approvals, and other unforeseen challenges. Remember, you don't get a return during this time.

Higher Risk: Building from scratch carries risks that may impact your investment, such as cost overruns, construction delays, and potential design flaws. When building something for a specific tenant, there is also a chance that it is ‘too customised’ and therefore harder to lease out when they decide to move on.

Harder to access finance: Banks view construction as risky. This means they will restrict their lending amount and charge higher interest for new builds compared to buying existing property.

Buying an Existing Commercial Property

Pros of Buying an Existing Commercial Property

Immediate Income: If tenants are already occupying the space, an existing commercial property provides the opportunity for immediate rental income.

Reduced Risk: With an existing building, you can assess the location, condition, and rental history before purchasing. This enables you to reduce uncertainties that are often associated with new construction.

Faster Return on Investment: With an existing property, you can start generating rental income sooner and accelerate your return on investment.

Cons of Buying an Existing Commercial Property

Limited Customisation: An existing property may not perfectly align with your tenant's needs. To accommodate them, significant modifications or renovations could be required.

Maintenance and Upgrades: Compared to new builds, older properties typically require more maintenance and costly upgrades to meet modern standards.

Hidden Issues: With an existing building, there's a risk of undiscovered structural and maintenance issues resulting in to unexpected expenses after purchasing.

Market Availability: Finding the right existing commercial property can be challenging, especially in criteria markets and factoring in your specific investment criteria.

When does building give the best return?

In the past, the upfront costs for a new building were lower than the value of the completed build, providing instant capital gain. This usually occurs in a market where there is strong demand for new commercial buildings and people prefer to pay more for a ready-to-use space, rather than go through the build process themselves.

Another way to make strong gains is when land is obtained relatively cheaply. For example:

- The section was subdivided off another lot.

- A secondary building was put on a title, increasing the rentable value.

- The land was bought many years ago and has appreciated in value.

- The land was bought cheaply and has since risen in value due to rezoning or a resource consent obtained to allow industrial activity.

Commercial building valuations

The key is to work out the expected cost of the build and compare it to the value of the property once complete. The most accurate way to get a valuation is to ask a registered valuer or a real estate agent to look over your concepts. Banks will typically require this for loan approval.

You can also assess the current value or recent sales values of other similar buildings. Bear in mind that the RV of a property can be quite different to its value if it was sold today. This method can be difficult if you don't have a lot of close examples to compare to, for example, if you are building in a new industrial zoned area with few buildings complete.

Another method is to reverse engineer the rental yield into a dollar value because many investors look at this instead of the cost of construction. Using the formula below, you can determine the value of your property based on current market rental prices and the yield investors are looking for.

For exampleIf the rent of a warehouse is set at $100 per m² and an investor is looking for a 6% yield, we can work out what they might value the building at. For a 2,000m² warehouse this calculation could look like this: 2000*$100 = $200,000 rent PA. |

Conclusion

The decision to build or buy a commercial property hinges on your specific investment goals, financial situation, risk tolerance, and timeline. While building offers customisation and supports your long-term vision, it also involves higher initial costs and risks. On the other hand, buying an existing property provides immediate income and potentially lower upfront costs but may have limitations.

Before making a decision, it is crucial to conduct thorough research, consult with professionals, and carefully assess your objectives. Evaluating both options within the context of your overall investment strategy will help you determine whether building or buying a commercial property aligns better with your goals and resources.

Get in touch with the team of experts at XL Structural via email or book a discovery meeting. We are here to discuss what options may be best suited to your project.